The global pandemic has altered the way many companies do business. It was a sharp learning curve, forcing us to sink or swim.

Like many industries, the banking sector wasn’t immune to the tsunami of instability – quite the contrary. Covid-19 was only the start of uncertainty. It may have been the catalyst for rising interest rates, inflation, and political disruption, but what has become unquestionable is the fragility of financial institutions.

So, where does this leave commercial and business banking? To understand the challenges it faces, one needs to identify the threats.

Accelerated digital banking, a surge in cyber hacking, geopolitical threats, and climate change are all disruptive forces that can potentially reshape the sector.

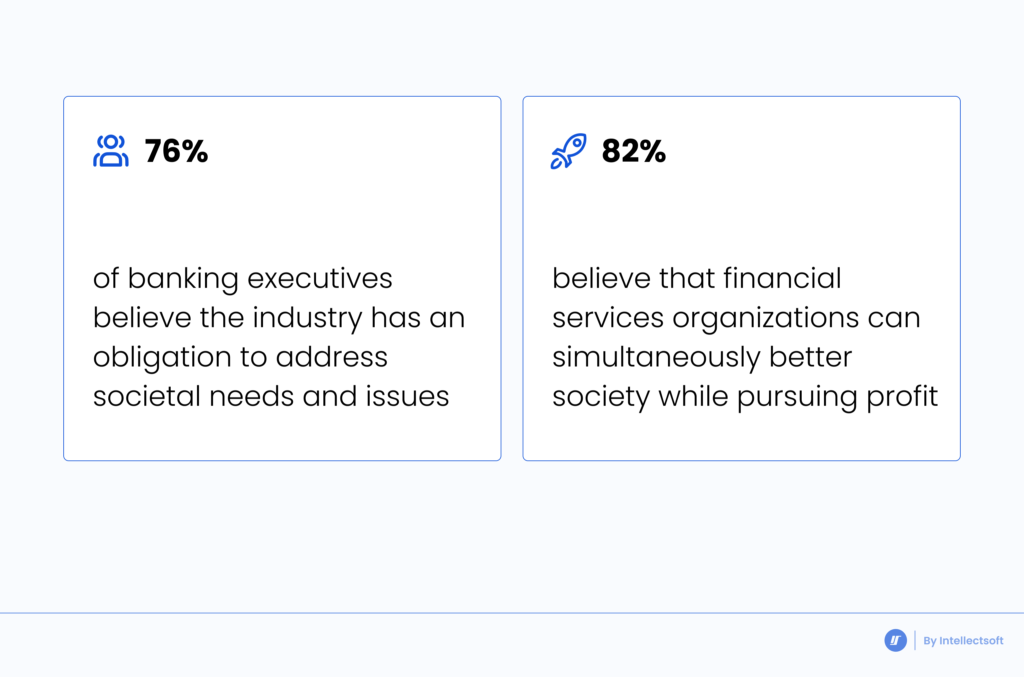

According to The Banking in 2035: global banking survey report, about 76% of banking executives surveyed believed the industry has an obligation to address societal needs and issues, while 82% were of the opinion that financial services organizations can simultaneously better society while pursuing profit.

How do banks go about doing this? By prioritizing client needs without compromising on profit. In this article, we’ll take a look at the future of business banking and how adopting certain business models can help you be at the forefront of future banking trends.

Future Business Models and Competitive Arenas in Business Banking

In the ever-changing business landscape, banking institutions have to fight to stay relevant. According to EIU’s financial outlook 2023 report, fintech and cryptocurrency sellers will find it harder to weather the storm.

Adapting to your new reality isn’t always easy, but adjusting your business model is one way of keeping abreast of the latest developments.

Banks that are open to change can benefit directly from disruptions “by combining their unparalleled domain expertise, reputation, and relationships with innovations in technology and a client-centric approach,” said Dr. Christian Thun while writing for Moody’s Analytics Risk Management: The Decade Ahead.

“Fortunately, the business banking sector has proven its resilience over the past decade by bolstering their capital and liquidity positions, and leaving behind non-core activities and markets,” EIU’s financial outlook 2023 report found.

It also sets up the sector for benefiting from future trends by improving digital services, becoming more financially inclusive, and investing in sustainable banking services.

So, what will business banking look like in the future?

Accenture’s Global Banking Lead Michael Abbott’s predictions could soon become a reality. According to him, business and corporate banks’ innovative products could mirror that of the Amazon Prime model.

Just like mobile platforms, banks will take a dip into the metaverse, which will open a world of possibilities, but Abbott warns this won’t be without risk.

As a way of outperforming their peers, banks must help their clients solve their problems rather than increase their customer base. This taps into the notion of “life centricity”, whereby institutions take a holistic approach to customer wellbeing.

Abbott also believes data should be viewed as a product “that has the potential to transform the foundations of banking.”

The Banking in 2035: global banking survey report mirrored Abbott’s predictions when listing its most important outcomes for banks over the coming decade, with improved cybersecurity and data protection leading the pack with 46%.

The Impact of Data and Money Regulation on Business Banking

Banking regulations are a way of enforcing rules to protect the client, ensure financial stability and prevent financial crime. By design, they ensure sound banking practices.

Who regulates the banking system? In the US, four federal agencies have been tasked with this duty, namely the Office of the Comptroller of the Currency, the Federal Deposit Insurance Corporation, the Federal Reserve System, and the Consumer Financial Protection Bureau.

Easier access to data has become a building block for successful business practices, and a way of doing this is via application programming interfaces. APIs have been utilized in the banking sector for years, even more so in recent times.

But like other innovations, data sharing raises questions around privacy and regulations in the digital market.

The 2007-2009 financial crisis was a huge eye-opener for banks, prompting governments to install their own initiatives.

OECD cited an example of this with the 2015 EU Payment Services Directive II (PSD2) – a regulation that aims to enhance competition by granting open access to certain types of customer banking data for nonbank licensed providers.

During its research into Digital Disruption in Banking and its Impact on Competition, the NPO mentioned how Japan revised its Banking Act in 2017 to include provisions encouraging banks to open their APIs and facilitating banks’ acquisition of or collaboration with FinTech firms.

Nonetheless, banks can leverage their digital technologies in response to regulatory authorities’ questions by improving both regulation and supervision and, in turn, helping regulators and firms decrease the costs of compliance, OECD recommended.

Implementing Digital Transformation for Business Banking

Customer expectations are growing, and so too should your business if you want to grow with them.

Digital transformation is a given when it comes to business banking. By taking advantage of the huge data pool, businesses can automate processes and reduce costs.

Simple changes such as AI, cloud technology, and automation can help improve services and functionality, resulting in customer loyalty.

Below are the key drivers to consider when going digital: